Introduction: Advancing Toward True Financial Security

Financial security is not achieved in a single leap—it is built through structured, sequential steps. After mastering the fundamentals—such as budgeting, debt control, and emergency preparedness—the next phase requires deeper strategic thinking. This is where many professionals, executives, and entrepreneurs either accelerate toward long-term stability or stagnate due to lack of direction.

Steps 4 to 6 represent the core growth phase of financial security. At this stage, individuals move beyond survival and into strategic wealth construction. These steps focus on intelligent investing, risk management, and income diversification—elements that separate financially secure individuals from those merely managing expenses.

This article explores Steps 4 to 6 of building financial security, providing a comprehensive, CEO-level framework designed for professionals who want sustainable financial resilience in an unpredictable global economy.

Step 4: Strategic Investing for Long-Term Financial Growth

4.1 Why Investing Is Essential for Financial Security

Saving alone does not create financial security. Inflation erodes cash value over time, making investing a non-negotiable component of long-term stability. Strategic investing allows capital to grow faster than inflation while generating compounding returns.

For executives and professionals, investing is not speculation—it is intentional capital allocation.

Key objectives of strategic investing:

- Preserve purchasing power

- Generate long-term growth

- Build passive income

- Reduce dependency on active work

4.2 Understanding Risk vs. Volatility

Many people confuse risk with volatility.

- Volatility is short-term price movement.

- Risk is the permanent loss of capital.

Financially secure investors understand that controlled volatility is acceptable if long-term fundamentals remain strong.

CEO-level investors:

- Focus on asset quality

- Diversify intelligently

- Avoid emotional reactions

4.3 Core Investment Asset Classes

4.3.1 Equity Investments (Stocks and ETFs)

Equities remain one of the most powerful tools for long-term wealth creation.

Benefits:

- High growth potential

- Liquidity

- Ownership in productive businesses

Best practices:

- Invest consistently

- Favor diversified ETFs or strong fundamentals

- Avoid speculative timing

4.3.2 Fixed Income and Bonds

Bonds provide:

- Stability

- Predictable income

- Portfolio balance

They act as shock absorbers during market downturns.

4.3.3 Real Estate as a Security Anchor

Real estate contributes to financial security through:

- Rental income

- Asset appreciation

- Inflation protection

Strategic real estate investors focus on:

- Cash flow

- Location fundamentals

- Conservative leverage

4.3.4 Alternative Investments

Alternative assets include:

- Commodities

- Private equity

- Digital assets

- Intellectual property

These assets enhance diversification when used responsibly.

4.4 Investment Time Horizon and Discipline

Financial security requires patience. Short-term thinking destroys long-term outcomes.

Disciplined investors:

- Define clear time horizons

- Ignore market noise

- Focus on compounding

Time in the market consistently outperforms timing the market.

Step 5: Risk Management and Wealth Protection

5.1 Why Risk Management Is a Pillar of Financial Security

Building wealth without protecting it is one of the most common—and costly—mistakes. Financial security depends not only on growth, but on the ability to withstand shocks.

Risk management ensures that unexpected events do not erase years of progress.

5.2 Personal and Financial Risk Categories

Key risk categories include:

- Health risks

- Income disruption

- Market volatility

- Legal liabilities

- Business risks

Each must be addressed systematically.

5.3 Insurance as a Strategic Tool

Insurance is not an expense—it is risk transfer.

Essential coverage includes:

- Health insurance

- Life insurance

- Disability insurance

- Property insurance

- Liability protection

For executives and entrepreneurs, inadequate coverage creates disproportionate exposure.

5.4 Legal Structures and Asset Protection

Wealth protection also involves legal strategy.

Tools include:

- Trusts

- Holding companies

- Separate business entities

- Estate planning documents

These structures protect assets from:

- Litigation

- Creditors

- Succession uncertainty

5.5 Diversification as Risk Control

Diversification reduces dependency on any single asset, industry, or geography.

Effective diversification includes:

- Multiple asset classes

- Global exposure

- Different income sources

Overconcentration is the enemy of financial security.

5.6 Tax Efficiency and Regulatory Awareness

Taxes are one of the largest long-term wealth drains.

Financially secure individuals:

- Optimize income structure

- Use legal deductions

- Plan long-term tax strategies

Tax planning is a strategic discipline—not a last-minute activity.

Step 6: Income Diversification and Financial Independence

6.1 Why Income Diversification Is Critical

Relying on a single income stream—no matter how stable—is a structural weakness.

Financial security increases dramatically when income is:

- Diverse

- Scalable

- Partially passive

Diversification reduces vulnerability to economic cycles and career disruption.

6.2 Types of Income Streams

6.2.1 Active Income

Includes:

- Salary

- Business profits

- Consulting

While essential, active income depends on time and effort.

6.2.2 Passive Income

Passive income includes:

- Dividends

- Rental income

- Royalties

- Interest income

This income continues with minimal daily involvement.

6.2.3 Portfolio Income

Generated from investments:

- Stocks

- Funds

- Bonds

Portfolio income grows alongside capital appreciation.

6.3 Building Scalable Income Systems

Financially secure individuals focus on systems, not effort.

Scalable income characteristics:

- Repeatable

- Automated

- Independent of personal time

Examples:

- Digital businesses

- Investment portfolios

- Licensing models

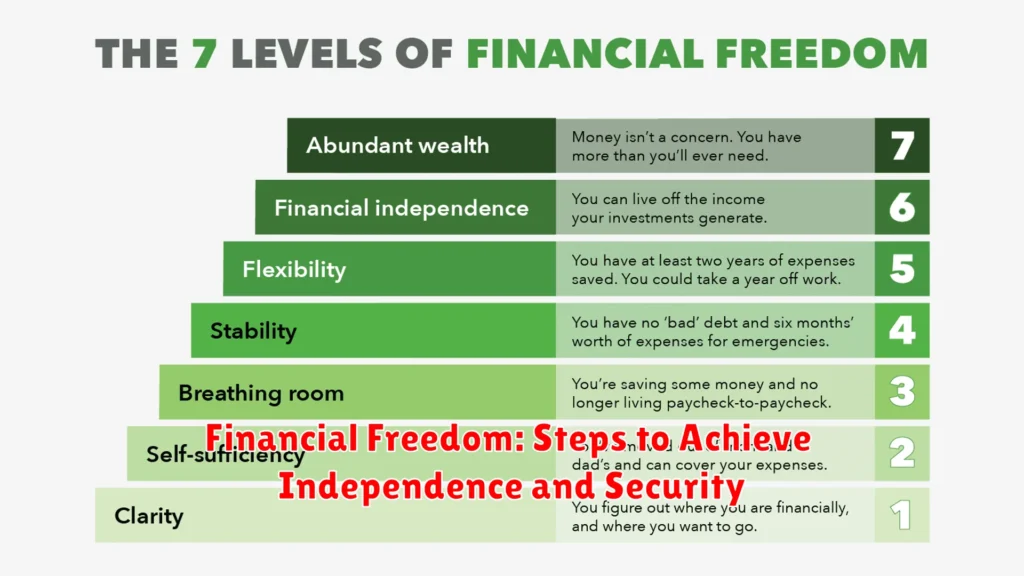

6.4 Transitioning Toward Financial Independence

Financial independence occurs when investment and passive income cover essential expenses.

This transition enables:

- Career flexibility

- Strategic decision-making

- Reduced financial stress

It does not require retirement—only optionality.

6.5 The Role of Technology in Income Diversification

Technology accelerates income growth through:

- Automated investing platforms

- Digital business models

- Global market access

Leaders who embrace technology gain structural advantages.

Integrating Steps 4 to 6 into a Unified Strategy

Financial security is strongest when these steps work together:

- Investing fuels growth

- Risk management protects progress

- Income diversification creates resilience

Ignoring any one step weakens the entire structure.

Common Mistakes in Steps 4 to 6

Avoid these pitfalls:

- Overconfidence in one asset

- Emotional investing

- Underestimating risk

- Ignoring insurance and legal protection

- Chasing short-term income

Consistency and discipline outperform complexity.

Building Financial Security in an Uncertain Economy

Economic cycles, inflation, and global instability make financial security more important than ever.

Steps 4 to 6 provide:

- Shock resistance

- Strategic flexibility

- Long-term confidence

Those who plan proactively gain control regardless of external conditions.

SEO Keywords (Suggested Global Keywords)

Primary keywords:

- Building financial security

- Financial security steps

- Long-term financial stability

- Strategic investing

- Risk management strategies

- Income diversification

Secondary keywords:

- Wealth protection

- Financial independence planning

- Investment portfolio strategy

- Passive income building

- Financial planning for professionals

- CEO financial strategy

Conclusion: From Stability to Strategic Freedom

Steps 4 to 6 mark the transition from financial stability to true financial security. This phase is where wealth compounds, risks are controlled, and income becomes resilient.

For professionals, executives, and entrepreneurs, financial security is not about avoiding work—it is about gaining leverage, flexibility, and confidence.

When investing is strategic, risks are managed, and income is diversified, financial security becomes durable—even in uncertain times.

Financial security is not built overnight.

But with the right steps, it becomes inevitable.

Word Count:

716

Summary:

Discusses the wealth building principles of goal setting, budgeting and self education.

Keywords:

goals,goal setting,budget,budgeting,investment,property investment

Article Body:

- Learn to Set Goals

Most self made, successful business people and investors have achieved their success by planning to do so.

They have set goals for themselves and achieved them. They invest time in reading and learning about wealth creation and are happy to learn from other people�s mistakes and experiences, as well as their own. They set goals, and realise that they will be far better able to achieve them if they familiarise themselves with the ways in which other people acted and the things that others have done to succeed. Wealthy people create wealth by carefully utilising the income that they have available to them to their best advantage. They know that working harder and longer hours is not the way to achieve financial freedom, instead they have to utilise what they have, and make it grow.

Having a goal enables you to focus your energies on devising ways to achieve it. When someone makes a decision and begins focusing on achieving a specific goal (and even better in a specific period of time), the powerful subconscious mind goes to work and begins playing with ideas and developing strategies of various ways to bring about the successful completion of the goal.

When you set yourself a goal both your conscious and subconscious start working on it and begin to develop an action plan. You will begin asking yourself questions about what needs to be done to enable you to reach your goal. Many find themselves coming up with amazing ideas and solutions to problems or obstacles that have been in the way of achieving their goal. The subconscious is an extremely powerful tool. The more often you remind yourself of your goal, the more your mind will work on ways for you to achieve it. Some people find answers come to them when they are asleep and dreaming.

Have you ever noticed that there is no correlation between being wealthy and having a high IQ or a university degree? If there were, every doctor and university graduate would be wealthy, and as statistics show, most of them end up in the same situation as 95% of the population.

Setting Goals helps you to focus your energy on developing workable strategies. Setting long term goals helps you look at the big picture. Once you can see the big picture, you can develop small sub goals. Sub goals are small simple goals that can be followed one step at a time. When you progressively achieve your sub goals, you will get closer and closer to your major goals. Goals are simply plans to succeed. It is said that if you �Fail to plan, then you plan to fail�. Goals help you keep motivated. Progressively achieving your goals can lead to a wonderful feeling of fulfilment.

- Learn how to Budget.

Budgeting does not have to be tedious. All you need to do is to work out:

What your incomings are. What your regular outgoings are and then make sure that all of your other expenditure is less than the amount remaining. This will allow you to start saving and investing. Budgeting puts you in control of your finances.

- Learn about investing � in particular about property investing.

Learn to research the property market, so that you will be able to purchase properties that will not only give a good rental yield, but they will also return the best capital growth possible. Read investment books. Read auto-biographies of successful people. Speak to people who have succeeded in doing what it is that you want to do. The more you learn, the easier it will be to recognise a good investment.

Find out about Negative, Neutral and Positive gearing � and why gearing is an invaluable tool, which will enable you to build up a wealth base in accelerated time, compared to if you only invested your own hard earned dollars.

Once you have educated yourself and understand why investing in property is such a powerful tool, you will be able to embark on the road to financial security.

In Australia, and many other countries less than 5% of the population reach retirement able to support themselves, without government or family assistance. If you want to be one of them, then now is the best time to start striving toward financial security.

Tinggalkan Balasan