Introduction: Why Financial Security Starts With Fundamentals

Financial security is not the result of luck, timing, or a single high-income year. For CEOs, executives, entrepreneurs, and professionals, financial security is a systematic outcome—built deliberately through disciplined decision-making and strategic planning.

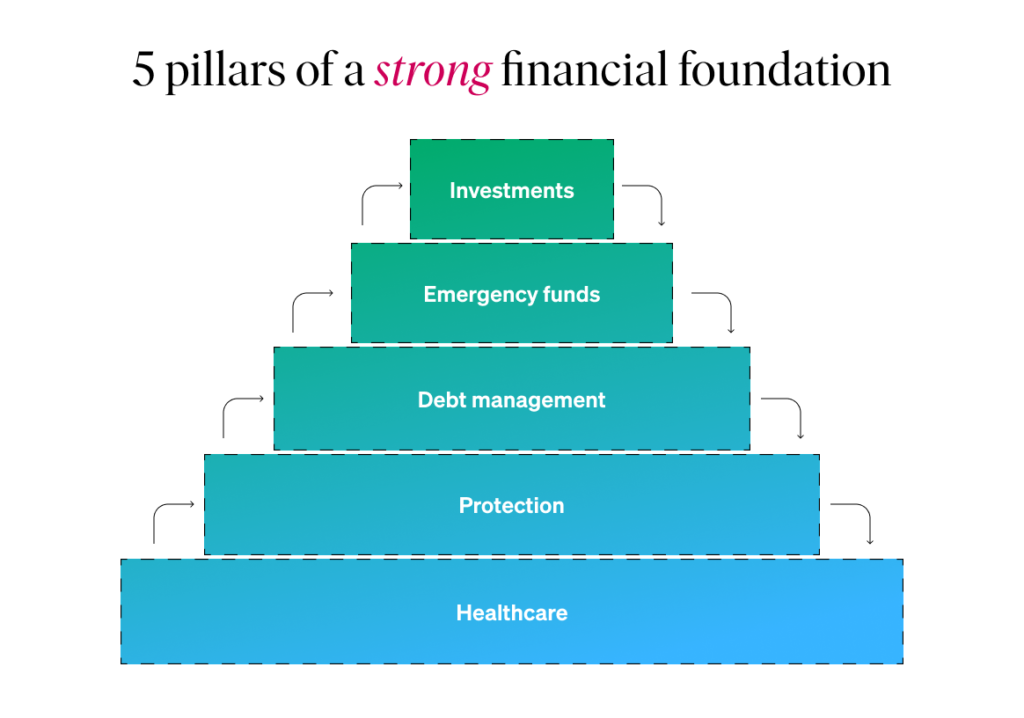

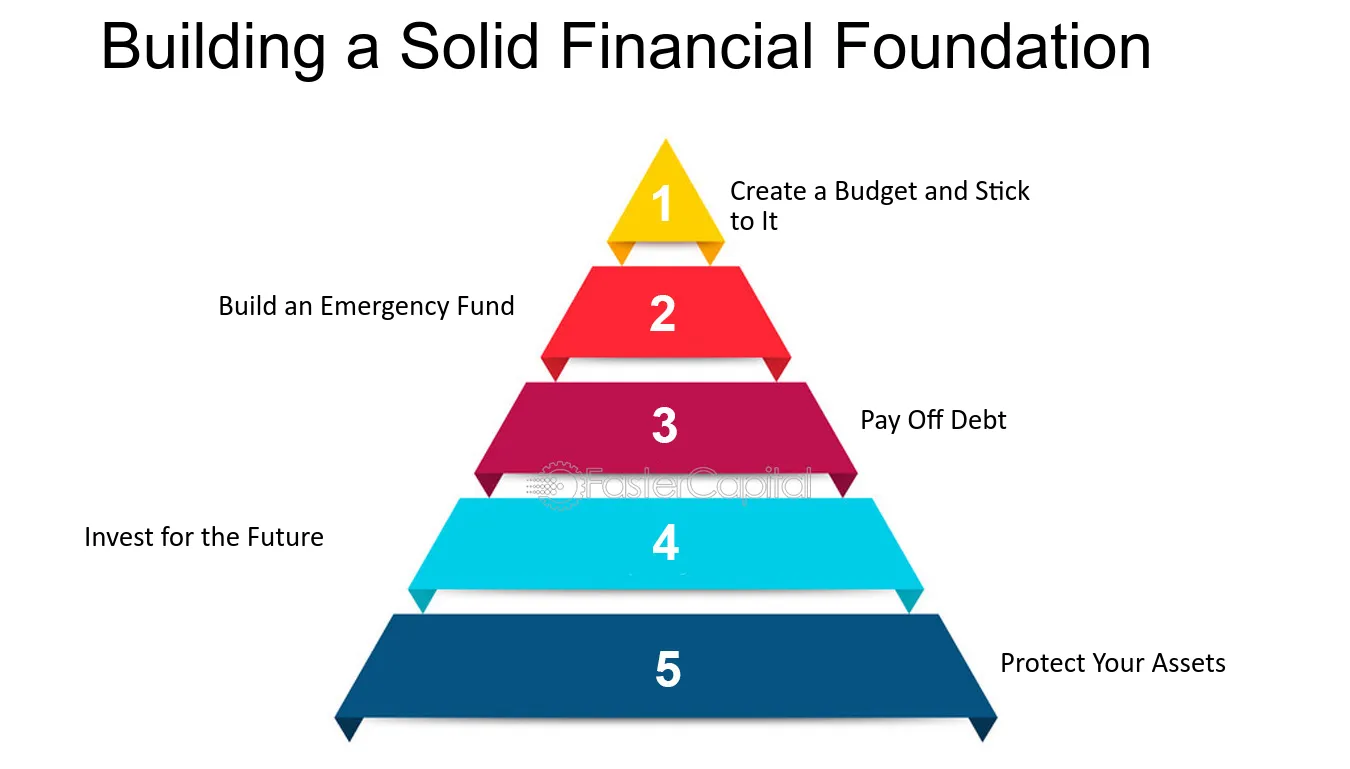

Before wealth can grow, before investments can compound, and before financial freedom becomes possible, there must be a solid foundation. Steps 1 to 3 are the foundation layer of financial security. These steps focus on control, stability, and resilience. Without mastering them, advanced strategies such as investing, diversification, or financial independence rest on unstable ground.

This article provides a CEO-friendly, practical, and strategic framework for Building Financial Security – Steps 1 to 3, designed for leaders who want clarity, confidence, and long-term financial control in an increasingly uncertain global economy.

Step 1: Financial Awareness and Cash Flow Control

1.1 Why Financial Awareness Is the First Non-Negotiable Step

You cannot secure what you cannot see. Financial insecurity often stems not from insufficient income, but from lack of visibility. Many high-earning professionals still experience financial stress because they do not fully understand their cash flow.

For CEOs and leaders, financial awareness means having:

- Complete visibility into income and expenses

- Clarity between personal and business finances

- Real-time understanding of cash movement

Financial awareness transforms money from a source of anxiety into a strategic tool.

1.2 Understanding Cash Flow at an Executive Level

Cash flow is the movement of money in and out of your financial system. At a CEO level, this must be approached strategically, not casually.

Key cash flow components:

- Active income (salary, bonuses, business profits)

- Fixed expenses (housing, insurance, debt obligations)

- Variable expenses (lifestyle, discretionary spending)

- Savings and reinvestment flows

The objective is not restriction, but intentional allocation.

1.3 Separating Personal and Business Finances

One of the most common mistakes among entrepreneurs and executives is mixing personal and business finances. This creates:

- Poor decision-making

- Tax inefficiency

- Reduced transparency

- Increased financial risk

Best practice includes:

- Separate bank accounts

- Clear compensation structures

- Defined reinvestment rules

Separation creates clarity. Clarity enables control.

1.4 Budgeting as a Strategic Tool, Not a Constraint

For CEOs, budgeting is not about cutting expenses—it is about aligning resources with priorities.

A strategic budget:

- Reflects long-term goals

- Protects essential spending

- Allocates capital toward growth

Budgeting at this level answers one key question:

“Is my money serving my strategy?”

1.5 Creating a Cash Flow Surplus

Financial security requires surplus. Without surplus, there is no buffer, no flexibility, and no opportunity.

Ways to create surplus:

- Eliminate low-value expenses

- Optimize recurring costs

- Increase income efficiency

- Reallocate spending toward high-impact areas

Surplus is the raw material of financial security.

Step 2: Debt Management and Financial Stability

2.1 Understanding Debt as a Strategic Variable

Debt itself is not the enemy—uncontrolled debt is. Financial security requires understanding the difference between productive leverage and destructive obligations.

At a CEO level, debt must be:

- Intentional

- Measurable

- Aligned with long-term objectives

2.2 Differentiating Good Debt and Bad Debt

Bad Debt:

- High-interest consumer debt

- Credit cards

- Lifestyle loans

- Debt with no income or growth potential

Good Debt:

- Business expansion leverage

- Cash-flow-positive real estate

- Strategic education or skill investment

Financial security accelerates when bad debt is eliminated and good debt is managed carefully.

2.3 The Psychological Cost of Debt

Debt is not only financial—it is psychological.

High debt levels:

- Reduce decision-making confidence

- Increase stress

- Force short-term thinking

CEOs with excessive personal debt often become risk-averse or overly aggressive—both are dangerous.

Reducing debt restores strategic calm.

2.4 Debt Reduction Strategies for Professionals and Executives

Effective approaches include:

- Prioritizing high-interest debt first

- Consolidating where beneficial

- Renegotiating terms

- Avoiding lifestyle inflation

The goal is not zero debt, but manageable, productive debt.

2.5 Maintaining Credit Strength and Liquidity

Strong credit provides:

- Lower borrowing costs

- Better negotiation power

- Emergency flexibility

Financial security requires maintaining access to capital—even if it is never used.

Step 3: Emergency Planning and Financial Resilience

3.1 Why Emergency Planning Defines Financial Security

Unexpected events are inevitable:

- Economic downturns

- Health issues

- Business disruptions

- Market volatility

Financial security is not about avoiding shocks—it is about absorbing them without collapse.

3.2 Building an Emergency Fund

An emergency fund is a liquidity shield.

Recommended benchmarks:

- 6 months of essential expenses (professionals)

- 9–12 months (entrepreneurs and executives)

This fund should be:

- Easily accessible

- Low-risk

- Separate from investments

Liquidity equals freedom in crisis situations.

3.3 Emergency Funds vs Investment Capital

One common mistake is treating investments as emergency reserves.

Key difference:

- Emergency funds protect stability

- Investments pursue growth

Mixing the two introduces unnecessary risk.

3.4 Insurance as a Strategic Defense Layer

Insurance is a core pillar of financial resilience.

Essential coverage includes:

- Health insurance

- Life insurance

- Disability insurance

- Property and liability coverage

For CEOs, underinsurance is a hidden vulnerability that can destroy decades of progress.

3.5 Preparing for Income Disruption

Financial security assumes income volatility—even for high earners.

Preparation strategies:

- Multiple income streams (later steps)

- Emergency liquidity

- Fixed cost optimization

- Conservative lifestyle planning

Resilient leaders plan for worst-case scenarios while pursuing best-case outcomes.

3.6 Psychological Security and Decision Quality

When emergency systems are in place:

- Stress decreases

- Decision-making improves

- Risk is evaluated rationally

Financial resilience creates mental clarity—an underrated leadership advantage.

Integrating Steps 1 to 3 Into a Unified Foundation

Steps 1 to 3 are interconnected:

- Cash flow awareness creates surplus

- Surplus enables debt control

- Debt control enables emergency resilience

Ignoring one weakens the others.

A financially secure foundation allows leaders to:

- Think long-term

- Invest strategically

- Lead with confidence

Common Mistakes in Steps 1 to 3

Avoid these leadership-level errors:

- Overestimating income stability

- Ignoring small recurring expenses

- Treating debt casually

- Underestimating emergency needs

- Relying solely on income growth

Discipline beats income at this stage.

Why CEOs and Executives Must Master the Foundation

High income does not equal financial security. Many senior professionals remain financially fragile due to poor fundamentals.

CEOs who master Steps 1 to 3 gain:

- Financial clarity

- Strategic flexibility

- Emotional resilience

- Stronger leadership presence

Financial stability amplifies leadership effectiveness.

SEO Keywords (Suggested Global Keywords)

Primary keywords:

- Building financial security

- Financial security steps

- Cash flow management

- Debt management strategies

- Emergency fund planning

Secondary keywords:

- Financial stability for executives

- Personal finance for CEOs

- Financial resilience

- Budgeting strategies

- Risk management basics

Conclusion: Strong Foundations Create Strategic Freedom

Steps 1 to 3 are not glamorous—but they are decisive. They form the foundation upon which all wealth, investment, and financial independence is built.

For CEOs, professionals, and entrepreneurs, financial security begins with:

- Clear visibility

- Controlled obligations

- Preparedness for uncertainty

Once these fundamentals are mastered, higher-level strategies become not only possible—but sustainable.

Financial security is not about earning more.

It is about building strength beneath success.

Word Count:

692

Summary:

Discusses the wealth building principles of compounding interest, leverage and property investment.

Keywords:

compounding,compound interest,gearing,leverage,property investment,investment

Article Body:

We would all like to think of ourselves enjoying the good things in life, not having to stress about finances, and not having to be concerned about growing old, poor.

But if we are currently living from pay cheque to pay cheque, never seeming to get ahead or having any savings, how do we change things? Where do we start in our quest for financial security?

The best thing we can do, is sit down, take a deep breath and contemplate the differences between the haves and the have nots, the achievers and the laymen. What is it that the successful and wealthy do, that is different to us? What are the principles that they utilise to create wealth?

Once we find out the principles that others who have created financial security have used, it seems that then the only step left would be for us to try and duplicate the process.

Following is a list of some of the wealth building principles that I have discovered in my study of and conversations with successful people.

These concepts have been utilised extensively by those who have already created enormous wealth.

- Use the power of Compounding Interest/Growth. John D. Rockerfeller once described compounding interest as the �Eighth Wonder of the World�.

Compounding is also referred to as Rate & Time because the longer the time, and the higher the growth rate, the greater the effects of compounding become.

Compounding works by letting any interest earned get added to the initial investment, and then the next lot of interest is calculated on the sum of the two, and so on. Interest is earned on interest. This gives the effect of exponentially increasing the value of an investment.

One of easiest ways to calculate how compounding interest works with different rates of return is to become familiar with the Rule of 72. This rule states that �The number of years that it will take for your money to double is 72 divided by the interest (growth) rate�.

Therefore if you have $1,000.00 invested at 10% interest, then the number of years that it will take for your money to double to $2000.00 is 7.2.

72 divided by 10 = 7.2

- Use the tried and true method of investing in residential real estate.

Statistics show that over 98% of the world�s millionaires have made their money through property.

It should really not come as a surprise, because everyone needs a place to live, and generally at least one third of the population are renting. Property is a necessity, so it can never go out of fashion.

As the population increases, so does the need for housing. The laws of supply and demand therefore will ensure that prices keep rising.

Banks consider property to be one of the most secure investments and because of this they will loan you a high percentage of the value. This leads to the next principle.

- Using Other Peoples Money or Gearing is a tool used extensively by the wealthy.

Why is using Other People�s Money so important? The reason is that it is possible to use �leverage�, also known as �gearing� to obtain a greater result, than you could have obtained using only your own contributions. The word leverage comes from �lever�. As you know a small amount of force applied on one end of a lever, can produce force far greater than what was initially exerted. A lever has the effect of multiplying the power exerted.

In the case of investing, it is referred to as leveraging when you use just a small portion of your own money, say 10% deposit on a $300,000.00 house, and borrow (leverage) the rest, in this case 90%. The capital growth that you benefit from is then calculated on the full $300,000.00, not just the $30,000.00 that you personally contributed, having the effect of multiplying your capital gain.

Gearing allows you to purchase a far more expensive property than you could if you were using only your own money. Controlling assets of a higher value means that compounding growth has more to work on, and therefore your net worth will increase much quicker. Gearing allows you to build an investment portfolio more quickly than would otherwise be possible.

Tinggalkan Balasan