Financial Freedom: A CEO-Friendly Guide to Building Wealth, Stability, and Long-Term Success

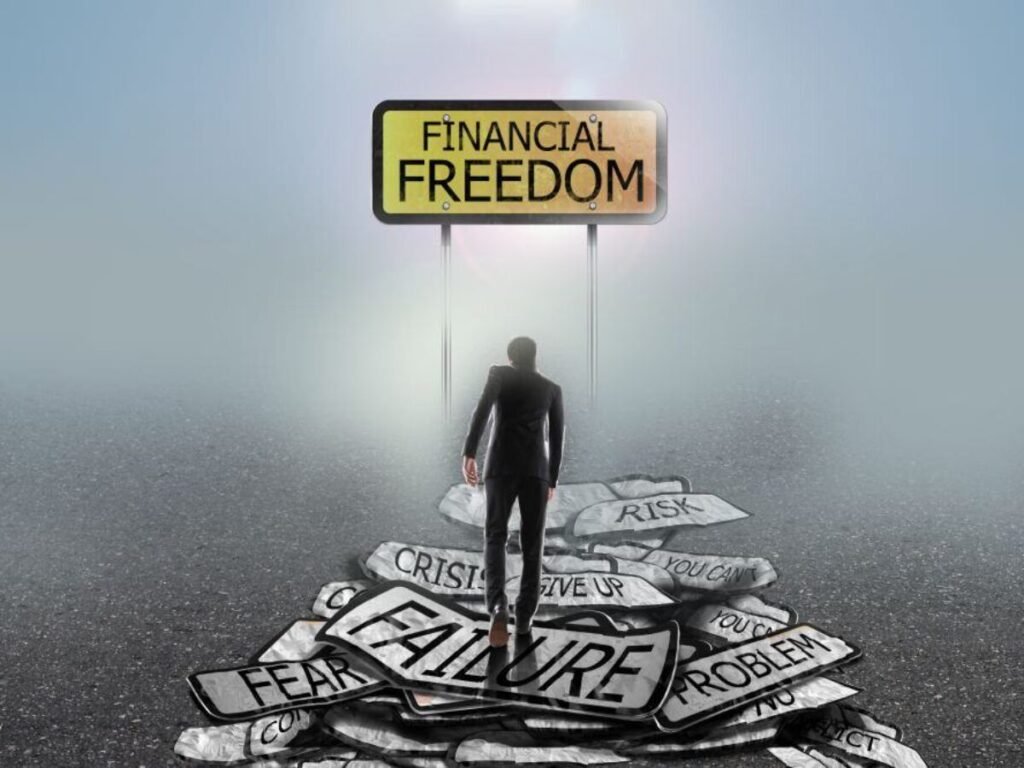

Introduction: Why Financial Freedom Matters More Than Ever

In today’s fast-moving global economy, financial freedom has become more than a personal aspiration—it is a strategic necessity. For executives, entrepreneurs, business owners, and professionals, financial freedom represents control, resilience, and the ability to make decisions without being constrained by short-term financial pressure.

Unlike the outdated idea that financial freedom is simply about being “rich,” modern financial freedom is about choice. It is the ability to allocate time, capital, and energy toward high-impact goals—whether that means scaling a business, investing in innovation, supporting family security, or contributing to society.

In an era shaped by digital disruption, economic uncertainty, automation, and rapid market shifts, leaders who understand and pursue financial freedom are better positioned to thrive. This article provides a comprehensive, CEO-friendly roadmap to financial freedom—covering mindset, strategy, income, investment, risk management, and long-term sustainability.

1. Defining Financial Freedom in the Modern Context

1.1 What Financial Freedom Really Means

Financial freedom is the condition where your passive and strategic income exceeds your living and operational expenses, allowing you to make decisions based on opportunity rather than obligation.

For executives and entrepreneurs, financial freedom means:

- Freedom to choose strategic direction

- Freedom to invest without desperation

- Freedom from constant cash-flow anxiety

- Freedom to step back from daily operations if desired

It does not necessarily mean retiring early—it means owning your time and financial decisions.

1.2 Financial Freedom vs. Financial Independence

While often used interchangeably, these concepts differ slightly:

- Financial Independence: You no longer rely on active work to cover expenses.

- Financial Freedom: You have flexibility, optionality, and control over money, time, and lifestyle.

Most CEOs aim not to “stop working,” but to work by choice, not necessity.

2. The CEO Mindset: Thinking Like a Financial Strategist

2.1 Wealth Is Built by Strategy, Not Salary

High income alone does not guarantee financial freedom. Many executives earn substantial salaries yet remain financially constrained due to lifestyle inflation, poor capital allocation, or lack of investment strategy.

Financially free leaders:

- Think in terms of systems, not paychecks

- Focus on assets, not just income

- Prioritize long-term leverage over short-term comfort

2.2 Long-Term Vision Over Short-Term Consumption

A CEO-friendly financial mindset includes:

- Delaying gratification for scalable outcomes

- Allocating capital toward growth assets

- Viewing money as a tool, not a reward

This shift separates high earners from wealth builders.

2.3 Risk as a Managed Variable

Financial freedom does not mean avoiding risk—it means managing and pricing risk intelligently. Leaders understand that:

- Not taking risk is also a risk

- Diversification is strategic protection

- Data-driven decisions outperform emotional reactions

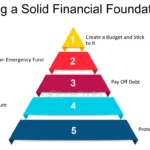

3. Building Strong Financial Foundations

Before pursuing advanced investment or wealth strategies, a solid foundation is essential.

3.1 Cash Flow Mastery

Positive and predictable cash flow is the backbone of financial freedom.

Key principles:

- Track personal and business cash flow separately

- Maintain liquidity for opportunities and emergencies

- Optimize expenses without sacrificing strategic growth

A financially free CEO knows exactly where money comes from and where it goes.

3.2 Emergency and Opportunity Capital

Financial freedom requires:

- An emergency fund (6–12 months of core expenses)

- Opportunity capital for investments, acquisitions, or innovation

Liquidity equals flexibility.

3.3 Eliminating Bad Debt

Not all debt is equal.

- Bad debt: high-interest consumer debt that produces no return

- Good debt: strategic leverage used for growth, assets, or expansion

Financial freedom accelerates when bad debt is eliminated and leverage is intentional.

4. Income Expansion: Beyond a Single Source

4.1 Why Single Income Is a Strategic Risk

Relying on one income stream—no matter how large—creates vulnerability. Market shifts, organizational changes, or health issues can disrupt even the most stable positions.

Financially free leaders design multi-layered income systems.

4.2 Active Income Optimization

Active income includes:

- Executive compensation

- Business profits

- Consulting or advisory roles

Strategies include:

- Negotiating equity, not just salary

- Performance-based incentives

- Advisory board positions

4.3 Passive and Semi-Passive Income Streams

These are essential for financial freedom:

- Dividends from stocks or ETFs

- Rental income from real estate

- Royalties or licensing income

- Business ownership without daily involvement

The goal is income that works while you don’t.

5. Investing as a CEO: Strategic Capital Allocation

5.1 Investment Is a Leadership Skill

CEOs allocate capital for businesses—financially free CEOs allocate capital for life.

Smart investing requires:

- Clear objectives

- Risk tolerance assessment

- Time horizon clarity

5.2 Core Investment Categories

5.2.1 Equity Markets

Stocks, ETFs, and funds provide:

- Long-term growth

- Liquidity

- Inflation protection

A disciplined, diversified approach outperforms speculation.

5.2.2 Real Estate

Real estate offers:

- Cash flow

- Appreciation

- Tax efficiency

Many financially free leaders use real estate as a stability anchor.

5.2.3 Private Equity and Startups

Higher risk, higher potential return:

- Angel investing

- Venture capital exposure

- Strategic partnerships

Best suited for experienced investors with surplus capital.

5.2.4 Alternative Assets

Including:

- Commodities

- Digital assets

- Intellectual property

These assets add diversification when used responsibly.

6. Time Leverage: The Ultimate Wealth Multiplier

6.1 Why Time Is More Valuable Than Money

Money can be earned again. Time cannot.

Financial freedom is ultimately about time leverage:

- Delegation

- Automation

- Systemization

6.2 Building Systems That Run Without You

Financially free leaders:

- Build management layers

- Automate financial tracking

- Outsource low-value tasks

Freedom increases as dependence on personal involvement decreases.

6.3 From Operator to Owner

The shift from operator to owner is critical:

- Owners design systems

- Operators maintain systems

Financial freedom grows as you move up this hierarchy.

7. Risk Management and Wealth Protection

7.1 Protecting What You Build

Wealth creation without protection is fragile.

Key protection strategies:

- Insurance (health, asset, liability)

- Legal structures (trusts, holding companies)

- Estate planning

7.2 Diversification as Defense

Diversification across:

- Asset classes

- Industries

- Geographies

This minimizes exposure to systemic shocks.

7.3 Tax Efficiency as a Strategic Advantage

Smart leaders:

- Use legal tax optimization strategies

- Structure income efficiently

- Plan long-term, not year-to-year

Tax strategy is part of wealth strategy.

8. Financial Freedom for Entrepreneurs

8.1 Separating Business Wealth from Personal Wealth

A common mistake among founders is tying all wealth to one company.

Financial freedom requires:

- Extracting profits strategically

- Investing outside the core business

- Reducing concentration risk

8.2 Exit Strategy as a Freedom Tool

Even if exit is years away, planning early matters:

- Acquisition readiness

- Succession planning

- Valuation growth

A business is an asset—not a prison.

9. Psychological Freedom and Decision-Making Power

9.1 The Mental Impact of Financial Freedom

Financial freedom reduces:

- Stress

- Reactive decision-making

- Fear-driven choices

This leads to clearer leadership and stronger vision.

9.2 Freedom Improves Leadership Quality

Leaders with financial independence:

- Take calculated risks

- Invest in people and innovation

- Resist short-term pressure

Freedom enhances integrity and long-term thinking.

10. The Role of Technology in Achieving Financial Freedom

10.1 Automation and Financial Intelligence

Modern tools help:

- Track investments

- Analyze performance

- Optimize budgeting

Technology amplifies financial discipline.

10.2 Digital Platforms and Global Opportunities

Today’s leaders can:

- Invest globally

- Build remote income streams

- Access markets instantly

Geography is no longer a limitation.

11. Common Mistakes That Delay Financial Freedom

Avoid these traps:

- Lifestyle inflation

- Emotional investing

- Lack of diversification

- No clear financial roadmap

- Confusing income with wealth

Awareness prevents expensive lessons.

12. A Step-by-Step CEO Roadmap to Financial Freedom

- Master cash flow

- Eliminate destructive debt

- Build emergency and opportunity capital

- Create multiple income streams

- Invest strategically and consistently

- Protect assets and manage risk

- Optimize time and systems

- Plan legacy and long-term impact

Consistency beats intensity.

13. Financial Freedom and Legacy

True financial freedom extends beyond personal comfort. It enables:

- Generational wealth

- Philanthropy

- Social impact

- Mentorship and leadership contribution

Wealth becomes a tool for positive influence.

Conclusion: Financial Freedom Is Strategic Leadership

Financial freedom is not luck, inheritance, or speculation. It is the result of intentional strategy, disciplined execution, and long-term thinking.

For CEOs, entrepreneurs, and professionals, financial freedom unlocks the highest level of performance—because decisions are made from strength, not pressure.

In a world defined by uncertainty, financial freedom provides clarity.

In a competitive economy, it provides resilience.

In leadership, it provides vision.

Financial freedom is not the end goal.

It is the platform from which your best decisions are made.

Summary:

A serious look at what I believe wealth management, investing and saving is all about. I�ll detail the choices that I made and the ones that I wish I made which hopefully will open your eyes to the choices that you have.

Keywords:

Consumption or investment, investment choices, share market investment, power compounding, accumulation, safe investing, young investor, investment spending, revenue producing

Article Body:

Financial freedom eludes so many people these days who by all logical conclusions and observations should have obtained it. It�s commonly cited as one of the most important and sought after goals in life and yet is rarely attained. This article does not attempt to give you a magic formula for success but I do share with you the choices that made a difference to me and can, if you choose put you well on the path to freedom.

Consumption

You can choose to spend some or all of your money on �consumption� items. These include food, entertainment, holidays, housing, motor cars, hobbies, and so on. These are things we need to live on a day-to-day basis. They also consist of items that service the things we want and so improve lifestyle.

Investment

You can choose to spend some or all of your money on investment items such as revenue producing real estate, shares, interest bearing deposits, businesses that produce revenue, etc.

Consumption or investment

Two important factors need to be understood about the simple concepts of consumption and investment.

The first factor is that spending on �consumption� items results in reducing the total value of your assets (net worth). Spending on investment items aims to increase your net worth. The second factor is that you have choice. You can choose between spending on consumption or investment items.

Of course, the best spending patterns are those that aim to attain a balance between spending on consumption and investment items.

Choosing consumption or investment

You now know the difference between consumption and investment spending and that you can choose between the two.

All you need to do is to think before you spend. Consumption spending can contribute to your lifestyle (driving a new car is fun, even if it was bought on credit and has created a liability of three to five years of payments). Investment spending provides income and wealth.

Shades of Grey

There is, of course, some spending that is not clearly defined as consumption or investment. Buying your own home is considered by many to be an investment. It isn�t! The purchase usually is financed and the repayments are a liability. The upkeep of a house costs money. There are rates and taxes payable on it. You do not get any revenue from it. If you plan to sell it in a few years to make a profit on its increased value, then it may be an investment. However if you have to buy another house to live in are you really any better off?

Investment spending is necessary for building wealth

In order to build wealth, some investment spending is necessary. The more that goes into investment spending, the bigger and quicker your wealth will grow. However, if too much goes into investment spending, and not enough into consumption, then lifestyle can become meagre. But you can choose.

Accumulation over time

Most people are not born rich. Certainly, some inherit wealth, but consequently may not appreciate it. A few win wealth in lotteries, but ironically, perhaps because they have not worked for it, or are not used to it, could end up squandering the temporary riches.

Everyone, however, has one thing in common. The same amount of time goes past for each of us, and at the same rate. How you employ that time is significant.

Imagine that at the age of 21, you invested $1,000 at an average annual rate of return of 10%, and then by the time you reach 65, you would have accumulated over $70,000 without doing anything else.

If at the age of 21, you invested $1,000 at an average annual rate of return of 10%, and each month invested an additional $100, then by the time you reach 65, you would be a millionaire, without doing anything else.

If you did neither of these things, then the same time would pass, and you would not have accumulated any wealth.

These examples of investment, quite deliberately, use amounts of money that are affordable by most, and if spent on investment, rather than consumption, would probably not be missed.

In terms of investing, time is on your side.

Of course, you may not be 21 any more and you may wish to accumulate wealth at a faster rate. This is possible by increasing the amount invested, and the annual rate of return. It is not possible to systematically accumulate significant wealth (millions) without looking at a timeframe of several years (say 5 to 10). If you are trying to make more money in less time, then your objectives may not be realistic. Perhaps a lottery ticket, crossed fingers and large amount of luck could produce your desired result, but don�t hold your breath waiting.

The power of compounding

In the above examples there is an additional factor at work. The entire return was reinvested and participated in earning the same rate of return as the original investment. None of the investment return was withdrawn and spent on consumption items.

Tinggalkan Balasan